Hello (Numerai) world!

We’re Echelon, a father-son duo who’s been participating as a team in Numerai. We started a year ago as a team of three who submitted predictions for the Signals tournament. With the passing of our algorithm developer in January, we pivoted from Signal model development to model investing. We are currently focused on Numerai Main Tournament model portfolio investment via NumerBay (Thanks, Res & CoE!).

We wanted to share a bit about our thinking, and invite you to follow along with our results (including the good, the bad and the ugly!).

Our thinking

We’ve gotten to this point through a lot of trial and error. On that path, we’ve started to define (and refine!) our beliefs. They are:

- We believe in the Numerai data science community. It’s one of the most knowledgeable data science communities in the world.

- We believe in Numerai. We’re comfortable investing our own money into a tournament where Numerai acts as the referee and the results are somewhat a black box.

- We believe diversification will especially benefit staking on True Contribution (TC) due to how uniquely volatile and uncorrelated TC behaves.

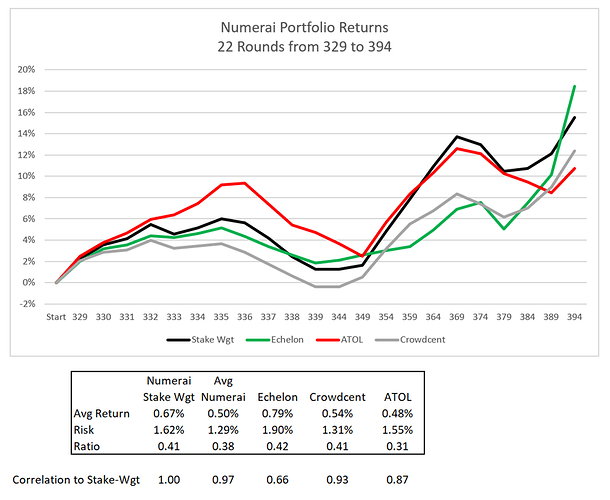

- We believe this portfolio can evolve to outperform the Numerai Main Tournament stake weighted average if we can employ insights from modelers and Numerai personnel. (This is one way that we will measure our ‘success’.)

- We believe that this, in turn, will improve Numerai’s meta-model (only slightly; we’re certainly not Richie Rich) which is good for all of us.

We certainly don’t have all the answers, and don’t pretend to. If you have any feedback on the items above, we’d love to hear it.

How you can follow along

For transparency, we are creating a common Echelon name for all of our Numerai Main Tournament slots. They’ll each contain “ECHELON_” at the beginning. Rest assured that they’ll never be our own ML predictions, but predictions that we’ve purchased via NumerBay.

Periodically, we will report on some total risk characteristics – mainly the effect of diversification. Other than a bias towards some performance persistence, we do not currently have any alpha strategies. Over time, we believe alpha strategies will arise within the Numerai ecosystem as a result of modeler and Numerai personnel interactions and insights. We believe a fund within Numerai’s ecosystem will be a natural place for risk controlled tests and implementation of these strategies.

We also believe that cross modeler ensemble investing will offer benefits to the Numerai ecosystem. Our current Numerai model selection criteria include performance, Corr correlation, modeler methods, dialogue and community reputation.

We look forward to interacting with you and developing this approach. You can find us on RocketChat at @greyone (aka Gerry) or @aqsmith (aka Aaron). Excited to be a part of the Numerai community and can’t wait to see what’s next.